After you incorporate your company under the Ontario Business Corporations Act (hereinafter “OBCA”), a first meeting of the shareholders has to be held during which one or multiple new directors need to be appointed.

You may recall the article “The Three Types of Actors in an Ontario corporation” that outlines the different roles entrepreneurs can have within a corporation. Building on that knowledge, this next article will examine the specific duties and liabilities of directors, and how directors can mitigate risks when acting on behalf of a corporation established under the Ontario Act.

If you are unsure about who can serve as a director of your company, you can consult the corporation’s key actors segment of our FAQ section.

What are the director's duties in Ontario ?

The primary duty of the director of a corporation, in Ontario, is to manage and supervise the corporation’s affairs. In doing so, a director can delegate powers and duties to certain offices or officers responsible for the day-to-day operations. Note that certain powers cannot be delegated, such as but not limited to, the ability to declare dividends or to adopt, amend and repeal by-laws.

To put it simply, a director’s duty is twofold:

- First, ensuring that the corporation acts in compliance with its statutes and regulations, and with the law at large.

- Second, supervising and overseeing the management of the corporation’s operations.

When a director makes a decision on behalf of the corporation, he or she should not rely blindly on the information at hand. Instead, the director should analyze whether or not there is reasonable grounds for questioning that information or interpretation of the information put forward. For example, a director can study the financial statements or the written reports presented in accordance with recognized accounting practices.

In any event, a director has to act in a manner that respects common law, statute law, and corporate law, precisely:

- the Ontario Business Corporations Act and its Regulations,

- the articles and regulations of the corporation, and

- any unanimous shareholders’ agreement.

These sources of law limit what and how a director may fulfill the role. In the following section, we will look at the fundamental duties of the director: the fiduciary duties.

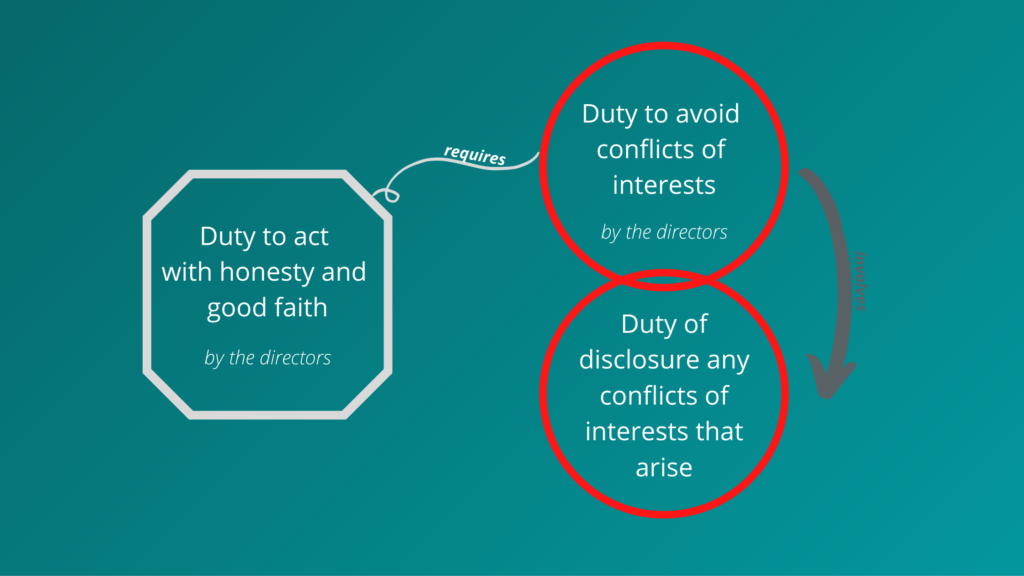

Duties of acting with honesty and in good faith

First, in Ontario, a director has a duty to act with honesty and in good faith in favour of the corporation in compliance with the general principles of common law and section 134(1)a) of the Ontario Business Corporations Act. This duty requires the director to exercise his or her role in the corporation’s best interests all times, and inside and outside the activities of the Board of Directors. In other words, in discharging his or her duties, a director must disregard any personal, shareholder’s, creditor’s or third-party’s interest.

In determining the best interests of the corporation, a director may be called upon to consider the interests of other stakeholders. In fact, a director upholds a duty to treat stakeholders, for example employees or shareholders who are affected by a corporate action, in an equitable and fair manner. Therefore, directors cannot plainly disregard the impacts of the corporation’s best interests on whom a decision will affect.

The Supreme Court of Canada summarizes that a director’s duty to act with honesty and in good faith entails:

- to respect the trust and confidence required in managing the affairs, and realizing the purposes and objectives of the corporation,

- to avoid from using the role of director for a personal benefit,

- to respect the confidentiality of any information acquired by virtue of the position,

- to serve the corporation selflessly, honestly, and with loyalty, and

- to avoid conflicts of interest with the corporation.

WHAT IS A CONFLICT OF INTEREST ?

A conflict of interest generally rises where a director’s personal interest conflicts with his or her duty as a director or when a conflict exists between duties owed to different companies of which the person is a director (Section 132(1)). As soon as a director’s objectivity, judgment or ability to act in the best interests of the corporation are compromised or appear to be compromised, a conflict of interest may exist.

The duty to avoid conflicts of interests may encompass a variety of specific or general situations provided by law or contract. For example, a director who purchases shares of a company which competes with your corporation or a director who uses the corporate property for their own benefit may be found in breach of this duty.

When a conflict of interest exists or appears to exist, the director must disclose it to the Board of Directors at the first available occasion (Section 132(2)). Then, the director should refrain from discussing or voting on any matter related to the conflicted situation, such as a transaction or contract stained by a personal benefit or a benefit of a corporation in which the director has an interest. Note that a director who fails to respect these requirements may be forced to account for a gain or benefit obtained in breach of this duty. In rare circumstances where the duty to disclose a conflict of interest has not been respected or cannot be respected, a director may be called upon to resign.

Duty of acting with care

Second, in Ontario, a director has a duty of care in favour of the corporation in accordance with section 134(1)b) of the Ontario Act and common law. This duty requires the director to exercise the care, diligence, and skill that a reasonable and prudent person would exercise in similar circumstances. Thus, a director must dedicate the necessary time and effort to make well-informed decisions that consider the context and characteristics of the corporation.

A decision made by a director does not have to be perfect. In fact, it has to meet the business judgment rule requiring a decision to fall within the range of reasonable alternatives. As a rule of thumb, an Ontario director’s decision should be supported by evidence showing that he or she took the necessary measures to make a well-informed decision. In doing so, a diligent director asks to have the decision recorded in the minutes of the meeting with all the supporting evidence.

When a decision is made by the Board of Directors and the director is absent from the meeting and/or dissents on the decision, it is recommended for that director to notify the dissent in writing because certain laws may hold liable directors that supported the decision being sanctioned.

A director can use the services of an expert to make a decision. To do so, a director has to ensure that the expert:

- has the appropriate qualifications and experience to advise on the matter,

- had the opportunity of consulting all relevant information to form his or her opinion, and

- used all relevant information before writing the opinion.

Note that directors of an offering company, which is a company that offers its securities to the public, has to respect additional duties provided by the Ontario Securities Act and its Commission.

As you can notice, a director has to respect many duties. In the next section, we will analyze what happens when a director fails to respect these duties and how a director’s liabilities are incurred.

What are the director's liabilities in Ontario ?

As a director of an Ontario corporation, what can you be held personally liable for?

ONTARIO BUSINESS CORPORATIONS ACT

In cases of improper purchase, acquisition of shares, or payment of dividends, a director may be held personally liable for the equivalent of the money that the corporation would have received had the shares been issued according to the expected standards of care (Section 130).

When the corporation is unable to repay its debts, a director remains personally liable to the employees of the corporation for all debts not exceeding 6 months’ wages and up to 12 months’ vacation pay while the director performs his or her services for the corporation (Section 131).

Lastly, a stakeholder such as a shareholder or a creditor of the corporation who can show that a board’s or director’s decision failed to respect the duty to treat stakeholders in a fair and equitable manner may have a claim under the oppression remedy. In this case, the decision has to be oppressive, unfairly prejudicial or disregards the interests of that party. In providing a relief, courts may redress any damage caused to the legal or equitable rights of the party through injunctions, damages, and more (Section 248). This remedy remains highly factual and open to interpretation by courts.

COMMON LAW

Under the common law of Ontario, a director’s personal tort liability is not necessarily protected simply because the director acts on behalf of a corporation. In other words, when a director commits an actionable wrong that would constitute a tort on its own, that director is not necessarily protected from a personal liability for the only reason that the actionable wrong was performed while fulfilling a corporate duty. Therefore, a director may be held liable for the tort in negligence for example, and exposed to remedies such as an injunction or compensatory damages.

STATUTE LAW

Federal, tax, employment or environmental laws may provide additional responsibilities and liabilities for directors. Contact us if you have any questions about your potential liability as a director.

More importantly, are there ways by which a director can reduce these liabilities?

How are the director's liabilities limited ?

In this last section, we suggest a number of steps that a director may undertake to limit the exposure to risks when acting on behalf of a corporation governed by the Ontario Act.

REVIEW THE CORPORATION'S BY-LAWS

The by-laws of a corporation usually contain a list of situations in which a director may be indemnified by the corporation when a claim is brought against him or her for an act committed as a director. A director can only be indemnified to the extent provided in the by-laws.

SIGN AN INDEMNITY AGREEMENT

This is a contract between the corporation and the director that provides when and how a corporation should indemnify a director for a claim brought against him or her while acting on behalf of the corporation. Although this agreement cannot go beyond what is provided in the corporate statutes, it may clarify or precise the extent of the protection and offer 2 additional advantages.

First, as a contract, an indemnity agreement cannot be altered without the express consent of the director whereas the by-laws may be changed at any moment by the shareholders without the director’s consent. Second, it may provide that the corporation has to offer and maintain in place a director and officer (D&O) liability insurance policy.

OBTAIN A D&O INSURANCE POLICY

The D&O insurance comes in handy when the corporation is insolvent because the OBCA holds directors personally liable for certain debts of the corporation once it files for bankruptcy. At this stage, you should keep in mind the coverage offered by the insurance policy and to file a claim before the end of the policy’s term applicable at that moment.

ESTABLISH A DUE DILIGENCE DEFENCE

We previously mentioned it: there are specific laws that impose additional duties on directors. In Ontario, the Income Tax Act, the Excise Tax Act, and the Retail Sales Tax Act enforce additional liabilities on directors. However, these acts allow the diligence defence to prove that the necessary care, diligence and skill have been used by a director.

RECORD ANY DISSENTING OPINIONS

Participating at all the meetings of the Board of Directors is important. If a decision is made that you disagree with, it is good practice to expressily request to register your dissent in the minutes of the meeting or to send a written notice to that effect to the secretary or the registered office of the corporation. Certain laws may impose liability on directors that voted in favour of the matter being sanctioned.

EXPERT ADVICE

A director that relies in good faith on the advice of an expert all while conducting his or her due diligence as highlighted in the section above is less likely to be found liable for a decision based on that expert’s advice.

UNANIMOUS SHAREHOLDERS' AGREEMENT

Although an unanimous shareholders’ agreement may restrict in part or in whole the powers of a director, it also shields the director from any liability for a power taken away by such an agreement.

RESIGN

This is the last option, but if everything else fails, resigning will allow a director to protect himself or herself for any liability that may arise from future events. That being said, a director remains held liable for past events.

A resignation should be conducted according to the statutes and regulations of the corporation and evidenced in writing. Moreover, the resigning director should file a notice of change under the Corporations Information Act. The date shown in the public record becomes the effective date of resignation, and limitation periods of most legal claims start running from that date.

Conclusion

To conclude, remember that:

- An Ontario director has to respect multiple duties when acting on behalf of a corporation, and when that director fails to meet those duties, he or she may be held liable under common law, statute law or corporate law.

- You are not alone; Lexstart is here to help you navigate any corporate risks without compromising your budget by offering affordable and customized legal services.

We hope that this article shed further light into the director’s responsibilities and liabilities. For more information in regard to the director’s role in a Ontario corporation or about the incorporation process, contact us.