The shareholders’ agreement in Canada ? In our previous article about the most common business structures in Ontario, we briefly discussed two protection tools available to the shareholders of a corporation, that is to say the shareholders, and the unanimous shareholders’ agreements.

In this article, we will explain what these agreements entail, and why it is important to have them, irrespective of where your corporation is registered or operating in Canada. In a complementary article, we will detail the provisions that these agreements may contain.

The fundamental principles

WHAT IS A SHAREHOLDERS' AGREEMENT IN CANADA ?

From a legal standpoint, it is a contract between two or more shareholders of a corporation OR between one or more shareholders and a corporation.

In Canada, from a practical standpoint, this document is above-all a framework that regulates and structures the relationship between shareholders, or between shareholders and the corporation. Precisely, it outlines the shareholders’ duties in favour of the corporation, or the other shareholders. This tool helps directors and shareholders to:

- preserve shareholding benefits and minimize risks,

- prevent and manage disputes between shareholders,

- anticipate foreseeable events, and

- dictate how to deal with unforeseeable events in a flexible manner.

Note, any shareholders’ agreement remains subject to the law of incorporation that governs the company (for example the Canada Business Corporations Act), and to the general rules of contract law provided by common law or the Civil code of Québec.

WHY SHOULD ANY CORPORATION HAVE A SHAREHOLDERS' AGREEMENT IN CANADA ?

The importance of having a sound and comprehensive shareholders’ agreement cannot be overemphasized because business relationships between shareholders, and the commercial reality of a corporation evolve quickly. When waters become murky, a shareholders’ agreement will help navigate those waters by circumventing or regulating conflicts.

Therefore, there are the two main reasons why a shareholders’ agreement represents an unavoidable asset for any canadian corporation:

- A shareholders’ agreement can provide clear and comprehensive guidelines to shareholders and directors on how to solve a specific problem between shareholders.

- A shareholders’ agreement can provide to directors and shareholders an effective mechanism for dealing with unforeseen problems between shareholders.

As a rule of thumb, and irrespective of the size of the corporation and market, as soon as more than one shareholder owns a right or an interest in a corporation, it is recommended to have a shareholders’ agreement. Furthermore, it is important to adopt that shareholders’ agreement as soon as possible; this is not only in the corporation’s best interests, but also in the shareholders’ interest because it avoids legal grey zones that cost a lot in attorney fees.

Moreover, in the absence of a shareholders’ agreement, it is the provincial or federal laws that apply. However, the applicable law does not necessarily cover all the matters that the shareholders may want to cover. A shareholders’ agreement will allow parties to take control over their relationship, and to address anything they decide in the manner they would choose.

Don’t panic; Lexstart is here to help you build your shareholder agreement! If you have any questions, contact us, or consult our affordable and personalized offer.

WHAT ARE THE TYPES OF SHAREHOLDERS' AGREEMENT IN CANADA ?

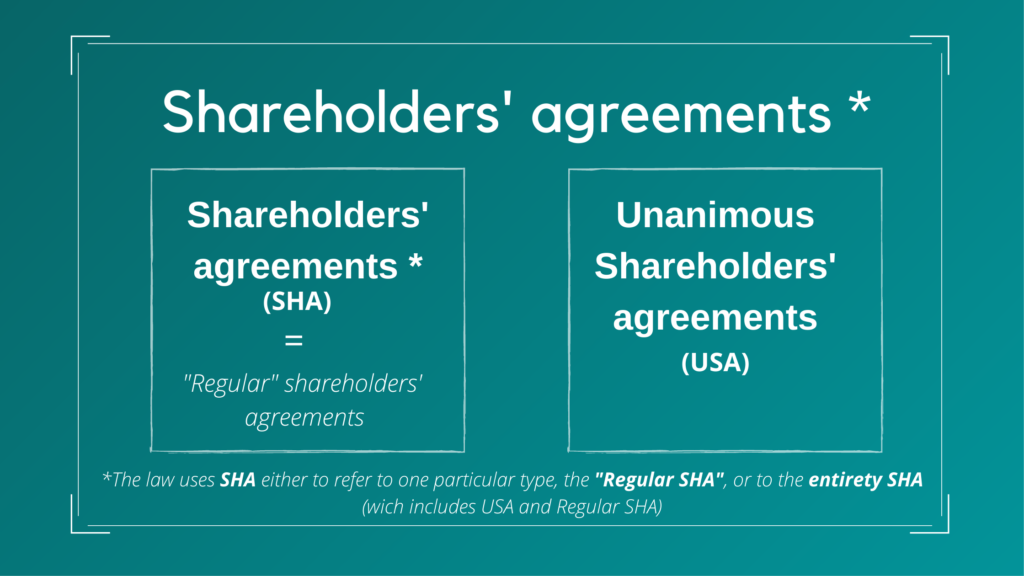

There are two types of shareholders’ agreement in Canada:

- the “regular” shareholders’ agreement (SHA), and

- the unanimous shareholders’ agreement (USA).

Practically speaking, the concept of “shareholders’ agreement” may refer to a “regular” shareholders’ agreement, or to the general contract between shareholders that encompasses both types of agreements; the “regular”, and the unanimous shareholders’ agreement.

WHAT SUBJECT-MATTERS DOES A SHAREHOLDERS' AGREEMENT COVER IN CANADA ?

Both the “regular” shareholders’ agreement (SHA), and the unanimous shareholders’ agreement (USA) may cover a wide variety of topics depending on the purpose and the parties involved in the agreement. Generally, the SHA and the USA tackle:

- The management, control and governance of the corporation, or

- The ownership, transfer, or sale of shares.

Within the first category, a shareholders’ agreement may provide the rules governing the size and election of the Board of Directors, or cover matters related to the procedures of board meetings by setting their frequency, the quorum or how meetings are being called.

Within the second category, a shareholders’ agreement may address the rights and obligations of shareholders with respect to the shares owned, and how those shares can be transferred, or under which circumstances a shareholder may opt out of the shareholding. Additionally, it may provide for specific situations like the death or the bankruptcy of a shareholder.

In our next section, we outline the specific characteristics of the shareholders’ agreement, and of the unanimous shareholders’ agreement.

The shareholders' agreement and the unanimous shareholders' agreement in Canada

In Canada, a unanimous shareholders’ agreement (USA) may cover the same matters as a “regular” shareholders’ agreement (SHA). As an example, here is a list of questions that either agreements may answer:

- What happens if a shareholder dies, or suffers from a disability or incapacity?

- What happens when a shareholder wants out of the corporation?

- What happens when you want to force a shareholder out of the corporation?

- What happens when a third-party wants to come into the corporation?

- What happens if a third-party comes into the corporation?

That being said, both agreements differ in their scope, objective, and obligations.

SCOPE OF THE AGREEMENTS

- SHA: binds only the shareholders that signed the agreement. Therefore, future shareholders have to expressly sign an existing SHA to be bound by it.

- USA: binds all the shareholders. The USA comes into effect with the assent of all the shareholders of the corporation, irrespective of the rights they hold in their shares. The consent of future shareholders is not required, provided notice is served. Failure to serve notice may allow a new shareholder to rescind the shares purchase within a delay provided by the law of incorporation.

OBJECTIVE OF THE AGREEMENTS

- SHA: provides the rights and obligations of shareholders, the resolution of specific disputes, or good management and governance practices.

- USA: restricts or withdraws, part or all, the powers owned by the directors (for example, section 108(3) of the Ontario Business Corporations Act).

DISCLOSURE OF THE AGREEMENTS

- SHA: no public disclosure of the agreement is required.

- USA: has to be disclosed to the territorial corporate authority where the corporation operates (for Quebec-incorporated companies, it is the Registraire des Entreprises du Québec).

To fully grasp the difference between a “regular” shareholders’ agreement, and an unanimous shareholders’ agreement in Canada, two additional precisions need to be made.

First, once a USA restricts or withdraws the powers of directors, a transfer of the rights and liabilities of the directors is operated to the shareholders. Therefore, directors cannot be held liable for powers they have been deprived of by a USA.

Second, an USA should treat shareholders’ fairly. On one hand, a USA should permit minority shareholders to avoid subjecting themselves automatically to the will of the majority shareholders when it is time to make an important decision. On the other hand, a USA should allow majority shareholders to avoid being blocked by minority shareholders by having the right of compelling them to make a decision.

In Canada, note that the provincial corporate laws of British Columbia, Nova Scotia and Prince Edward Island do not allow shareholders to adopt unanimous shareholders’ agreements.

Conclusion

To conclude, remember that:

- Shareholders’ agreements are essential tools to manage risks, and sustain growth for any corporation, irrespective of its size and where it operates in Canada.

- You are not alone; Lexstart is here to help you protect your corporation’s interests, and the rights of shareholders without compromising your budget by offering affordable and customized legal services.

We hope our article has raised further awareness about the shareholders’ agreement, and about why it is important to have one. For more information, please contact us. For more details about our process and Lex Start offers, please check our legal kits!